Questions?

You can learn about financial aid through numerous short videos. Browse by category (future student, current student, parent, or alumni), or by subject.

The cost of an education at the College of Coastal Georgia is extremely affordable. In-state tuition and fees are among the lowest in the southeast, and the cost for out-of- state students is inexpensive as well.

With more than 85 percent of our students receiving financial aid, you’ll find our quality education to be well within reach. In addition to being one of the best values in Georgia’s University System, the College also offers a wide array of scholarships. Incoming students can now apply for over 40 scholarships offered by the College with just one application. On-campus federal work study is also available for those who qualify.

The Office of Financial Aid & Veteran’s Affairs is dedicated to helping students and families apply for and obtain financial aid to assist them with pursuing their educational goals. This website is continuously updated with new and current information to inform you of new developments, deadlines and requirements.

Fill out the free application for Federal Student Aid (FAFSA).

A valid FAFSA, processed by the U.S. Department of Education, is required for the FAO to determine whether you qualify for federal aid. In order to complete the FAFSA, you must have already filed your federal tax returns for both student or student and parent if the annual income warrants having to file a return.

A bookstore credit will be available for use in the College’s bookstore if you have pre-registered, have financial aid in excess of the tuition and fees posted to your account, and do not have a previous balance. To receive the credit, you must authorize the College to do so in your COAST account. The bookstore credit will be available for at least four to five business days before the semester begins, and will expire at the close of business the day after drop/add.

Once full attendance verification is complete, your financial aid will be disbursed to your account (minus any bookstore charges). If this disbursement creates a credit balance on your student account, the Bursar’s Office will review it to determine if you are eligible for a refund. This will be determined based on factors such as your enrollment status and the amount of prior balances on your account. If you are eligible to receive the credit balance, it will be refunded to you.

Questions regarding your financial aid award should be directed to finaid@ccga.edu, or 912-279-5722. Questions regarding your refund, the MAC Card, or payments should be directed to the Bursar’s Office at 912-279-5746.

Hours Needed for Disbursement to Occur |

|

|---|---|

| Pell Grant & Teach Scholarships | Federal Grants are prorated based on the number of hours of enrollment. For example, half the amount is disbursed if a student is only enrolled half-time (6 credit hours). |

| Stafford & PLUS Loans | Student must be enrolled in at least six credit hours. |

It is highly recommended that you check your COAST account and your student email often. Make sure your fees are paid by the fee payment deadline.

The U.S. Department of Education (ED) regulations require that a student must be enrolled in a degree-seeking program to receive federal financial aid (Grants, Loans, FSEOG, Work Study). Finds will only be disbursed for courses that will fulfill unmet degree requirements, including applicable prerequisite/corequisite courses.

Students enrolling in courses that will not aid in completing their degree may see their financial aid prorated and/or cancelled as required by the Department of Education. Students are required to meet with their academic advisor before they register each semester; students should use that opportunity to ensure all courses aid in degree completion.

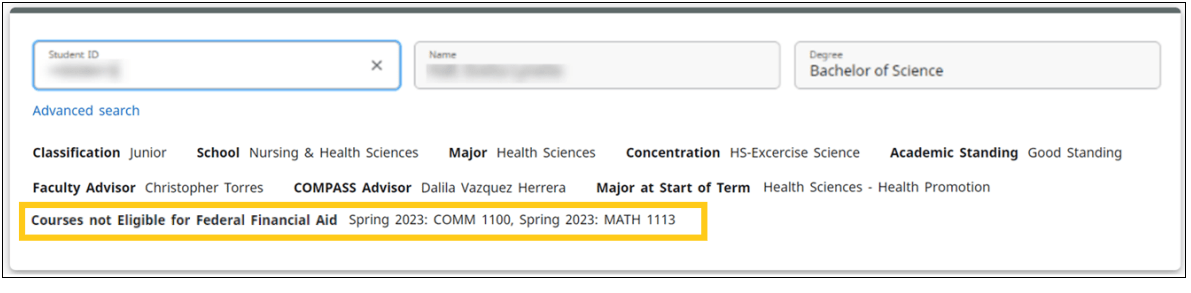

Course Program of Study (CPoS) is the process that is run to identify which courses will fulfill unmet degree requirements, including applicable prerequisites/corequisite courses. Courses that will not aid in degree completion will be ineligible for federal financial aid.

The CPoS process will run regularly throughout the registration period before and after classes begin, and students will be notified via their student email and messaged within the portal if they are registered for classes that will not count toward their degree.

Students must ensure that they are enrolled in courses that fall within their degree program. Should students decide to change their major and/or concentration, or should an advisor wish to request a course currently not counting toward a student’s degree program be substituted to satisfy a degree requirement, they must do so within the prescribed timeline below.

Priority Deadlines | ||

Semester | Change of Major/Concentration | Course Substitutions |

Fall | August 1 | August 1 |

Spring | January 2 | January 2 |

Summer | May 1 | May 1 |

Students should meet with their academic advisor or refer to their DegreeWorks to ensure that they are properly registered.

PLEASE NOTE: Processing for Major/Concentration changes or Course Substitutions received by the Office of the Registrar after the deadlines listed above cannot be guaranteed in time for the CPoS assessment and potential financial aid disbursement.

CPoS only applies to Federal Financial Aid (Pell Grant, SEOG Grant, Direct Stafford Loans, Parent PLUS Loans, etc.). It does NOT impact eligibility for state or institutional financial aid (HOPE/Zell Miller Scholarships, Coastal Georgia Institutional Scholarships, etc.).

Financial Aid awards are based on full-time enrollment, which is 12 more more credit hours per semester. Students enrolling in fewer than 12 credit hours may see their financial aid prorated based on applicable coursework.

Implementation of CPoS will begin Summer Semester 2023.

CPoS only applies to Federal Financial Aid (Pell Grant, SEOG Grant, Direct Stafford Loans, Parent PLUS Loans, etc.).

It does NOT impact eligibility for state or institutional financial aid (HOPE/Zell Miller Scholarships, Coastal Georgia Institutional Scholarships, etc.).

Students will be notified each semester via their Coastal Georgia email and via messaging in their portal. Students may also see this information in DegreeWorks; however, CPoS processes are not automatic and cannot be executed when registration initially opens. Each semester, CPoS processes will be run once per business day (excluding campus closures), starting at least 45 business days prior to the first day of class. Once the process has run, students will be able to determine in DegreeWorks if their classes are eligible for federal financial aid.

DegreeWorks Example:

The priority deadlines for making changes to my Program of Study are listed below.

Priority Deadlines | ||

Semester | Change of Major/Concentration | Course Substitutions |

Fall | August 1 | August 1 |

Spring | January 2 | January 2 |

Summer | May 1 | May 1 |

PLEASE NOTE: Processing for Major/Concentration changes or Course Substitutions received by the Office of the Registrar after the deadlines listed above cannot be guaranteed in time for the CPoS assessment and potential financial aid disbursement.

Definitely! Students are welcome to take classes outside of their program of study; however, they will required to pay for those classes out-of-pocket or with non-federal financial aid.

Students should consult with their academic advisors if they are notified that their classes do not satisfy any degree requirements. Advisors have access to determine if DegreeWorks is accurately reflecting enrollment. Degree requirements are based on the catalog year in effect when the student officially entered their program.

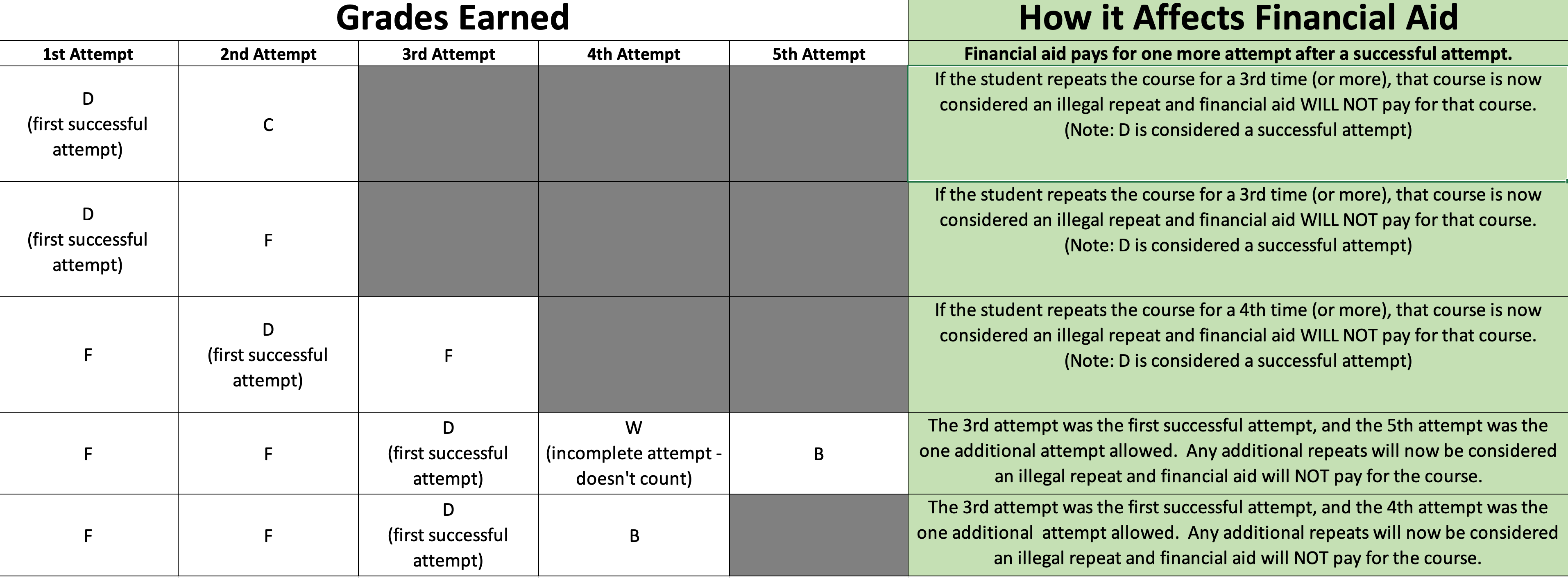

A course may satisfy degree requirements, but not count toward aid eligibility if it exceeds the number of repeat attempts allowed for federal aid. This is known as the Repeat Rule. If a student receives an ‘F’ grade in a course, they are permitted to retake the course as many times as they need until they make a ‘D’ or higher and have Federal Financial Aid cover the course. Once they have made a ‘D’ or higher, they are only permitted to retake the course one additional time after that and have Federal Financial Aid cover the course. This is regardless of what they make the next time or the grade required for progression in the pathway/program of study. While a ‘D’ may not be successfully passing to advance a student’s academic program, the federal government’s Repeat Rule considers a ‘D’ as having a passing grade.

For this purpose, passing means any grade higher than an ‘F,’ regardless of any school or program policy requiring a higher qualitative grade for the course to apply to the program of study. This retaken class may be counted towards a student’s enrollment status and the student may be awarded Federal Financial Aid for the enrollment status based on the inclusion of the class.

See Repeat Rule examples below:

Possibly. Electives must satisfy a requirement within your major and/or concentration. Each degree program has variable numbers of electives. Some programs have none or very few electives, while others have a significant number of electives available. If you have been notified that an elective will not count toward your degree, you MUST FIRST contact your academic advisor. If your advisor determines that the elective will satisfy a requirement, they MUST submit a substitution request or contact the Registrar’s Office.

Please Note: Substitutions MUST BE approved prior to the priority deadlines in order for classes to count and be eligible for financial aid.

Courses within double majors or double concentrations will be covered by CPoS rules. However, other federal regulations may apply which could limit funding eligibility. Should you have further questions, please contact your financial aid counselor.

Minor courses are not covered if the courses can only be used in the minor. If a course in the minor can doubly count toward their major/concentration, then it can be covered by CPoS rules. Please work with your advisor to use open elective sections of your major/concentration to ensure minor courses will be covered.

Courses that are prerequisite/corequisite to required courses but are not themselves explicitly listed within their program of study will be covered by CPoS rules, as long as the student does not exceed 30 credits of this nature. For example, corequisite support courses (e.g. MATH 0999) can be covered if a student is required to enroll in it in order to enroll in their Area A Math or English courses.

Unfortunately, you will not. A student has to be enrolled at least half-time (6 credit hours) in order to be eligible for federal loans.

The FAFSA Simplification Act was enacted into law as part of the Consolidated Appropriations Act 2021, and amended by the Consolidated Appropriations Act 2022. The act is an overhaul of the federal student aid processes, formulas and systems that will begin for the 2024-2025 award year. It brings about many changes for students and parents who complete the FAFSA.

As a financial aid recipient, it is your responsibility to know the following rules and regulations:

To ensure compliance with state and federal financial aid guidelines, the College of Coastal Georgia verifies attendance of all classes before financial aid is disbursed to a student’s account. If a student is not verified in attendance for a class, that class is dropped and financial aid is disbursed accordingly. If students are enrolled in second session classes, financial aid will not disburse to their accounts until after the class has begun and attendance verified.

A bookstore credit will be available for use in the College’s bookstore if you have pre-registered, have financial aid in excess of the tuition and fees posted to your account, and do not have a previous balance. To receive this credit, you must authorize us to do so in your COAST account by clicking on “financial aid,” then “student authorizations.” Make sure your address and contact information is up to date in COAST. Checks will be mailed to the address on file in Banner. Register for classes and check your financial aid status as well. You can view your authorized financial aid in COAST, under “student records,” then “student account,” and “account detail for term.” Any balance due must be paid in full by the first day of classes each semester.

The credit will be available at least four to five business days before the semester begins, and will expire at the close of business the day after drop/add.

In the above scenario, Jane would have her financial aid disbursed for the 12 credit hours after having been verified in attendance.

In this scenario, John would not be able to receive all his financial aid until after the class that begins on July 1 has been verified.

More than 85 percent of the students who attend Coastal Georgia receive some type of financial aid. This aid is funded through federal, state, outside scholarships and institutional scholarship funds.

Federal Stafford Loans are available to College of Coastal Georgia students for educational purposes. Parents may also borrow on their child’s behalf with a Parent PLUS Loan.

All students must submit the Fee Application for Federal Student Aid (FAFSA) and submit any requested documentation before applying for a student loan. The College of Coastal Georgia participates in the Federal Direct Loan Program for federal Stafford loans. Under this program, your lender is the US Department of Education. College of Coastal Georgia is not a lender. You may apply for a loan by selecting the link at the bottom of the page. Please read the important information below before you apply for a loan.

A bookstore credit will be available for use in the College’s bookstore if you have pre-registered, have financial aid in excess of the tuition and fees posted to your account and do not have a previous balance. To receive this bookstore credit, you must authorize us to do so in your COAST account (see instructions below). The bookstore credit will be available for at least four to five business days before the semester begins and will expire at the close of business the day after drop/add.

Once full attendance verification is complete, your financial aid will be disbursed to your account (minus any bookstore charges). If this disbursement creates a credit balance on your student account, then the Bursar’s Office will review the account to determine if you are eligible for a refund. This will be determined based on factors such as your enrollment status and the amount of prior balances on your account. If you are eligible to receive this credit balance, it will be refunded.

Important Action Items:

If you would like access to a bookstore credit, you must authorize it in your COAST account. Select Financial Aid in COAST, then Student Authorizations. Read and submit your response for each authorization. The Federal Funds Authorization applies to your bookstore credit.

Confirm that your address and contact information is up to date in COAST. Checks will be mailed to the address on file in Banner.

Register for classes and check your financial aid status in COAST. You can view your authorized financial aid in COAST under Student Records, then Student Account, and Account Detail for Term. Any balance due must be paid in full by the first day of classes each semester.

Questions regarding your financial aid award should be directed to finaid@ccga.edu, or 912-279-5722. Questions regarding your refund, the MAC card, or payments should be directed to the Bursar’s Office at 912-279-5746.

| Pell Grant & Teach Scholarships | Federal grants are prorated based on the number of hours of enrollment. For example, half the amount is disbursed if a student is only enrolled half-time (6 credit hours). |

|---|---|

| Stafford & PLUS Loans | Student must be enrolled in at least 6 credit hours. |

The Federal Direct Loan Program provides low-interest, long-term loans to students enrolled in eligible programs. The Department of Education determines if your loan will be subsidized or unsubsidized. To be eligible for Stafford Loans, students must be enrolled at least half-time (6 credit hours). Subsidized loans are interest free while you are enrolled at least half-time. Unsubsidized loans charge interest at all times.

College of Coastal Georgia has developed the processing of a Parent PLUS application into two separate electronic processes so that the parent’s identity can be verified before the application is processed. The federal government has defined a parent as either the student’s biological parent or their adoptive parent. (This is regardless of whether he or she is the “custodial” parent, or if they provided financial information on the FAFSA. A stepparent is eligible to borrow under the PLUS program. However, note that a legal guardian is NOT considered a parent for Federal Student Aid purposes). The following are the steps that must be taken in order to process a Parent PLUS application for College of Coastal Georgia.

By clicking “Apply for a Student Loan” below, you are verifying that you have read and understand the College of Coastal Georgia’s Student Loan Policy.

These are step by step instructions about loan processes. Please note that you are highly encouraged to borrow only what you need. However, if you decide that you would like to opt out of getting the Stafford Loan after it has disbursed, you have 14 days from the date of disbursement to contact our office and return the funds on your behalf.

OR

Before a loan can be disbursed, you must ensure you have done the following:

OR

To reduce or decline loans, do the following:

For purposes of Federal Student Aid, a parent is defined as your legal – whether biological or adoptive – parent or stepparent. The following people are NOT considered your parents unless you have been adopted: grandparents, foster parents, legal guardians, older brothers or sisters, and uncles or aunts. The College of Coastal Georgia has an in-house Parent Plus application in addition to the Federal Plus application that must be completed. This is done to ensure the privacy and the accuracy of the parental information. Below are the instructions for both:

NOTE: We highly encourage you to borrow only what you need. However, if you decide that you would like to opt out of getting the Parent PLUS loan, the parent has 14 days from the date of disbursement to contact our office and return the funds on their behalf.

The College of Coastal Georgia student and parents are welcomed to research for additional funds via private/alternative loan funds. When doing your research, please remember that lenders have varying requirements, so you must be sure to select the best one for your needs. Some requirements you may want to consider are as follows:

Once you have applied, the College will be notified so that we may be able to certify your loan. Understand that your loan will be certified according to the criteria set by your chosen lender. Also note that your loan can only be certified up to your Cost of Attendance.

A three-year cohort default rate is the percentage of a school’s borrowers who enter repayment on certain Federal Family Education Loan (FFEL) Program or William D. Ford Federal Direct Loan (Direct Loan) Program loans during a particular federal fiscal year (FY), October 1 to September 30, and default or meet other specified conditions prior to the end of the second following fiscal year. The College of Coastal Georgia is working with Student Connections, formerly USA funds, to assist with our cohort default rate. Please see our ratings below:

Cohort Rate | Draft Rate (February) | Final Rate (September) | National Rate |

Fiscal Year 2021 | 0 | 0 | 0 |

Fiscal Year 2020 | 0 | 0 | 0 |

Fiscal Year 2019 | 2.6 | 2.6 | 2.3 |

Fiscal Year 2018 | 5.5 | 5.2 | 7 |

Fiscal Year | 7.6 | 7.6 | 9.7 |

Fiscal Year 2016 | 4.8 | 4.8 | 10.1 |

Fiscal Year 2015 | 7.1 | 7.1 | 10.8 |

Fiscal Year 2014 | 12.8 | 12.8 | 11.5 |

Beginning the 2021-2022 academic year, students and parents who accept a new Stafford Loan must complete the Annual Student Loan Acknowledgement. This is a tool that the Department of Education created to keep borrowers informed about their loan debt. This acknowledgement must be completed each year that the student has a new Stafford Loan. The parent must also complete an acknowledgement each time they decide to get a new Parent Plus loan for the student to attend.

To complete the Annual Student Loan Acknowledgement, the student and/or parent will log into Studentaid.gov using their FSA ID (username and password). This process should take no longer than 10 minutes to complete. The experience will be personalized based on the borrower’s attributes. Below is a general description of the process.

| Dates | Deadlines |

|---|---|

| Feb. 1 | Deadline for submitting Foundation Scholarship Applications for incoming Freshmen |

| March 1 | Deadline for submitting Foundation Scholarship Applications for returning students and transfer students |

| April 1 | Priority deadline for submitting the completed and signed FAFSA for summer |

| April 15 | Priority deadline for submitting your summer loan application |

| May 1 | Priority deadline for submitting the required documentation requested by the Office of Financial Aid for summer |

| May 1 | Priority deadline for submitting the completed and signed FAFSA for fall |

| June 1 | Priority deadline for submitting the required documentation requested by the Office of Financial aid for fall |

| Nov. 1 | Priority deadline for submitting the completed and signed FAFSA for spring |

| Dec. 1 | Priority deadline for submitting the required documentation requested by the Office of Financial Aid for spring |

The Office of Financial Aid requires that all students who would like to receive financial aid for summer semester must submit a separate summer application.

Payment is due the day a student registers for courses if the student does not have enough financial aid to cover the current semester’s balance. If payment is not made at the beginning of the semester, the student’s courses may be dropped for non-payment and a late payment fee will be charged if courses are reinstated.

If a student has Veterans Benefits, they may be required to make payment at the time they have registered depending on the type of benefits they have and at what percentage those benefits are covered.

All payments are made to the Bursar’s Office located on the first floor of the Andrews Center.

The College of Coastal Georgia is committed to keeping you updated with changes to the student loan program.

The Department of Education recently announced a new one-time student loan cancellation based on income, as well as extending the payment and interest pause on federal student loans.

The Aug. 24 announcement included the following steps to help borrowers transition back to regular payments as pandemic-related support expires:

Visit the one-time student loan debt relief page for more information.

You may be wondering what you have to do to claim this relief. Here’s how to make sure you’re getting the latest information and updates as details are announced.

The College of Coastal Georgia has partnered with Student Connections to make sure every borrower who is eligible for loan forgiveness receives it, and help any borrower with a remaining balance to navigate and prepare for payments to resume January 2023. This service is completely free to you.

Student Connections Borrower Advocate can help answer any questions you have and determine what steps you need to take.

While you are in student loan repayment, Student Connections may contact you through emails, text messages and phone calls to:

These advocates are available to answer any questions about your outstanding loans and, when appropriate, work with you and your loan servicer. Visit www.repaymyloans.org or talk to a borrower advocate for free at (866)-311-9450.

Student Connections is passionate about helping students. They partner with schools to provide support for borrowers throughout the student loan repayment process. With more than 60 years of experience in counseling student loan borrowers, their primary goal is to help establish the best repayment plan for you.

Susan Bratten

Financial Aid Counselor (A – I)

Antonio Vazquez-Herrera

Financial Aid Counselor (J – M)

Nicole Ransom

Financial Aid Counselor (N – Z)

Antonio received his Bachelor of Arts in Spanish with a minor in French from Emory University in Atlanta, GA. He began his career at the College in 2021 as a Financial Aid Customer Service Clerk.

You can learn about financial aid through numerous short videos. Browse by category (future student, current student, parent, or alumni), or by subject.

Coastal Georgia has partnered with Goodwill to select students for their Path to Success program.

This website uses cookies. Find out more in our Privacy Notice: https://www.ccga.edu/privacy/. For Data Service requests, fill out this form.